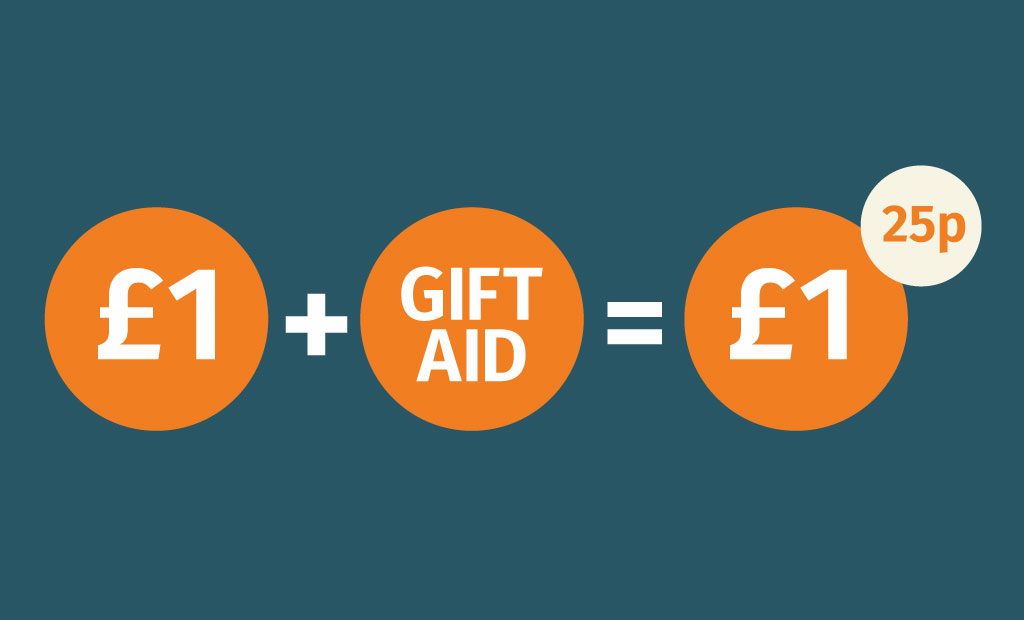

What is Gift Aid?

Gift Aid is a simple scheme that allows charities, including PTAs, to increase the amount raised from donations by UK taxpayers. Donors complete a Gift Aid declaration, which enables the PTA to claim back the basic rate of income tax on their donations (around 25% extra) and doesn’t cost the taxpayer any more.

Does my PTA have to register with the Charity Commission to claim Gift Aid?

Not necessarily. Your PTA must register as a charity with the Charity Commission for England and Wales if its income is more than £5,000 per year. Otherwise, apply to HMRC to become recognised for tax purposes. Once approved, you will receive a reference number and confirmation of the date your entitlement to claim Gift Aid begins. In Scotland, you should apply to the Office of the Scottish Charity Regulator (OSCR). In Northern Ireland, it’s possible to claim Gift Aid as long as you have been granted charitable tax status by HMRC even if you aren’t yet registered with the Charity Commission for Northern Ireland.

What is a Gift Aid declaration?

For outright gifts to your PTA, eligible parents and other supporters should fill out a Gift Aid declaration form, which you keep on file. HMRC has a sample declaration form, but you can also design your own. The signed declaration acts as a statement from the donor to confirm they want to donate through Gift Aid and for the PTA to receive the tax back. Supporters only need to sign the declaration once, as it provides cover for every gift made to the same charity. It can cover any period the person chooses, and can include gifts they have made in the past four years as well as gifts they may make in the future. If your donor stops paying tax, they should let you know. The PTA must give the donor an adequate explanation of the personal tax implications associated with making a Gift Aid donation and be able to demonstrate it has been given.

Is a signature required on a Gift Aid declaration?

No, HMRC does not require a signature on your Gift Aid declarations. Declarations can also be made orally, though the charity will then need to give the donor written confirmation of the declaration.

On which common PTA activities can we claim Gift Aid?

Some of the most popular PTA activities for which Gift Aid might apply are:

- Building and equipment appeals

- A voluntary donation on top of the price of an event admission

- Sponsorship money

- Non-uniform days

- Regular donations

Which activities don’t qualify?

You cannot claim Gift Aid on donations where the donor gets something in return. Examples include:

- Admission to an event

- Buying items such as books, jumble sale items, or food

- Payment for raffle or lottery tickets (including 100 clubs)

Check the official list to find out what can and can't be claimed, here: https://www.gov.uk/claim-gift-aid/what-you-can-claim-it-on

Can Gift Aid be claimed on small cash donations?

The Gift Aid Small Donations Scheme (GASDS) is designed for small cash donations such as bucket donations at a school concert, where it would be difficult to obtain a Gift Aid declaration. To make use of the GASDS, PTAs should already be claiming Gift Aid in the same tax year and must not have been issued with a penalty in the last two tax years. There’s no need to provide donor information when you claim.

How do I make my claim?

You can file your Gift Aid and Gift Aid Small Donations Scheme (GASDS) claims using HMRC’s online service or by using a paper form.

Are there any easier ways to claim Gift Aid?

Many online giving platforms will collect Gift Aid from the government on your behalf. Download and fill in the forms from the website of your chosen platform.

Further reading and useful links

- Register with HMRC

- England and Wales: The Charity Commission

- Scotland: Office of the Scottish Charity Regulator (OSCR)

- Northern Ireland: The Charity Commission for Northern Ireland

The above is intended as guidance only. We recommend that you contact the relevant organisations with specific reference to insurance, legal, health and safety and child protection requirements. Community Inspired Ltd cannot be held responsible for any decisions or actions taken by a PTA, based on the guidance provided.

.gif)